Beware of Scammers Posing as Azura Credit Union

Fraudsters are using increasingly sophisticated tactics to impersonate financial institutions, like Azura, in an effort to steal personal and financial information. One of the most recent scams going around relies on a combination of Text Message and Website Spoofing to deceive consumers. If you receive a text or call asking you for account or identifying information, it is not Azura.

What is Caller ID Spoofing?

Caller ID Spoofing is a technique used by scammers to make a call or text appear as if it's coming from a trusted phone number—such as Azura’s official number or website. This creates a false sense of security, making it more likely that consumers will trust the caller or texter.

What is Website Spoofing?

How the Scam Works

- It starts with a text or phone call. The scam begins with a text message or call appearing to come from your financial institution, warning about fraudulent charges on your debit card.

- The member responds. If you reply to the text message denying the charge, you may soon receive a phone call from the scammer. Or, if you visit a link listed in the text, it may send you to a website that appears legit.

- The scammer tried to obtain account details. Under the guise of “verifying” the account, you are asked to share sensitive information. This may be by phone or via a form on the spoofed website. Questions may include:

- Online banking username

- A new online banking password (chosen by the scammer)

- Social Security Number

- Full debit card details

- One-time passcodes sent by your financial institution

- The scammer steals money. Some fraudsters will also instruct you to transfer funds via payment apps like Cash App or Apple Cash, claiming it will “protect” your money. In reality, the transfer sends funds directly to the scammer.

Red Flags to Watch For

While scammers can be persuasive, there are clear warning signs that can help you identify a fraudulent text or call.

Azura will NEVER contact you and ask you the following:

- Your full credit or debit card number

- The expiration date on your card

- Your card's Personal Identification Number (PIN)

- The CVV code on the back of your card

- One-time passwords or access codes

- Your full Social Security number

- Your Online Banking credentials

- Change your Online Banking password to something they provide.

- Transfer money to “protect” your account.

What to Do If You Receive a Suspicious Text or Phone Call

If you get a call or text from someone claiming to be from Azura and asking for personal or financial information:

- Hang up immediately. Or, do not reply or click links within the text.

- Call Azura directly at 785-233-5556 or toll-free at 800-432-2470 to verify the legitimacy of the call. Or, visit our website to chat with a representative online.

- Never share personal details, passwords, or verification codes by phone, text or email.

Protect yourself by staying informed. If something feels off, trust your instincts. Azura is always here to help keep your accounts safe.

Spot a Scam

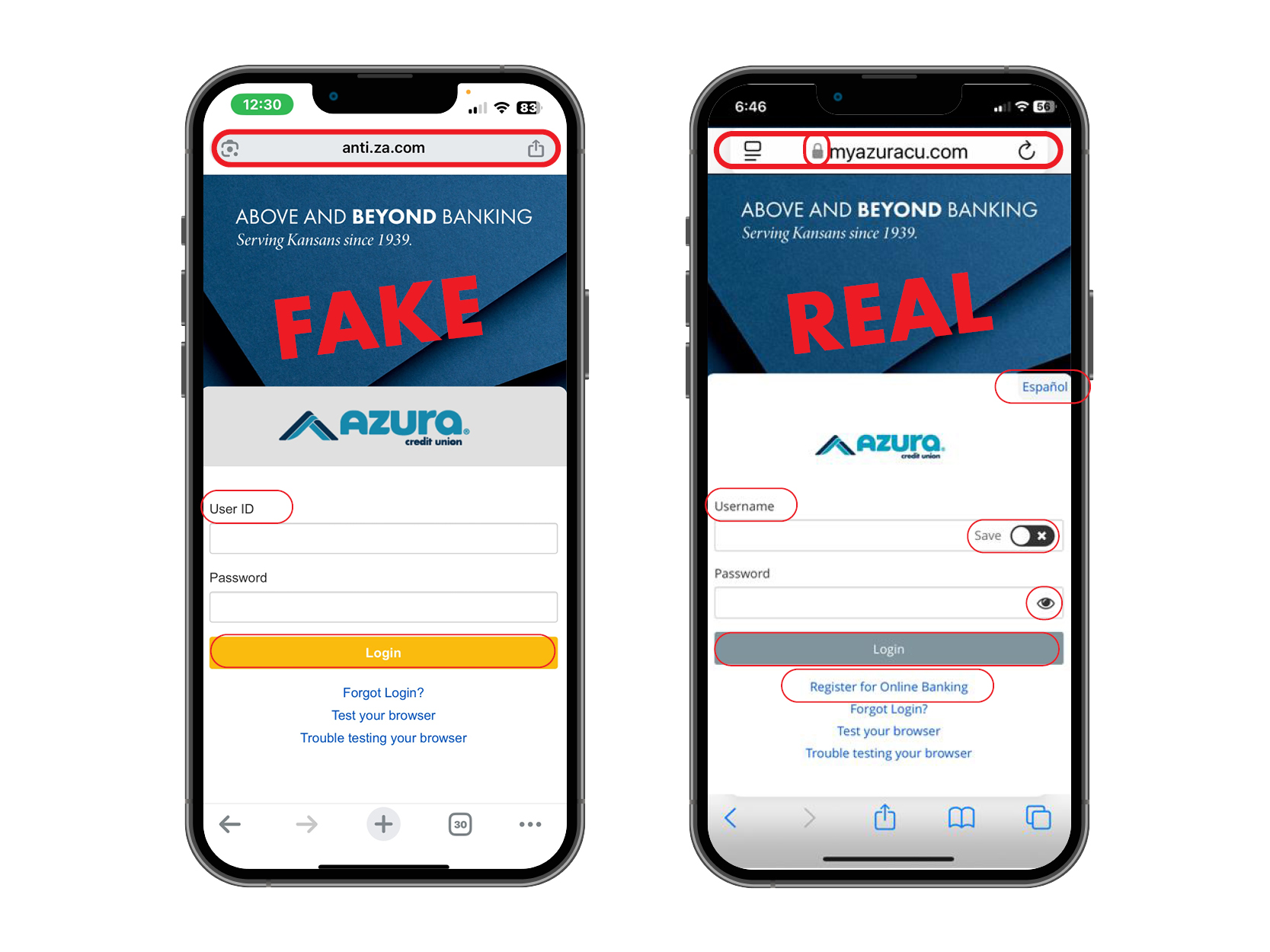

- Verify the URL and look for security indicators. Check for HTTPS and the padlock icon: Legitimate websites, especially those requesting sensitive information, should use HTTPS encryption, indicated by "https://" in the URL and a padlock icon in the address bar.

- Scrutinize the domain name. Spoofed websites often have URLs with slight misspellings, extra characters, or unusual domain endings (like ".net" instead of ".com"). Always double-check the domain name before entering any information.

- Avoid clicking links in suspicious emails or messages. Instead, type the website's address directly into your browser or use a search engine to find the legitimate site. This bypasses potential malicious links within the message.

- Watch for slight variations in logo styles, design and colors, field names (User ID vs Username) or missing elements.